arininstudio.ru Tools

Tools

How Much Wood Fencing Cost

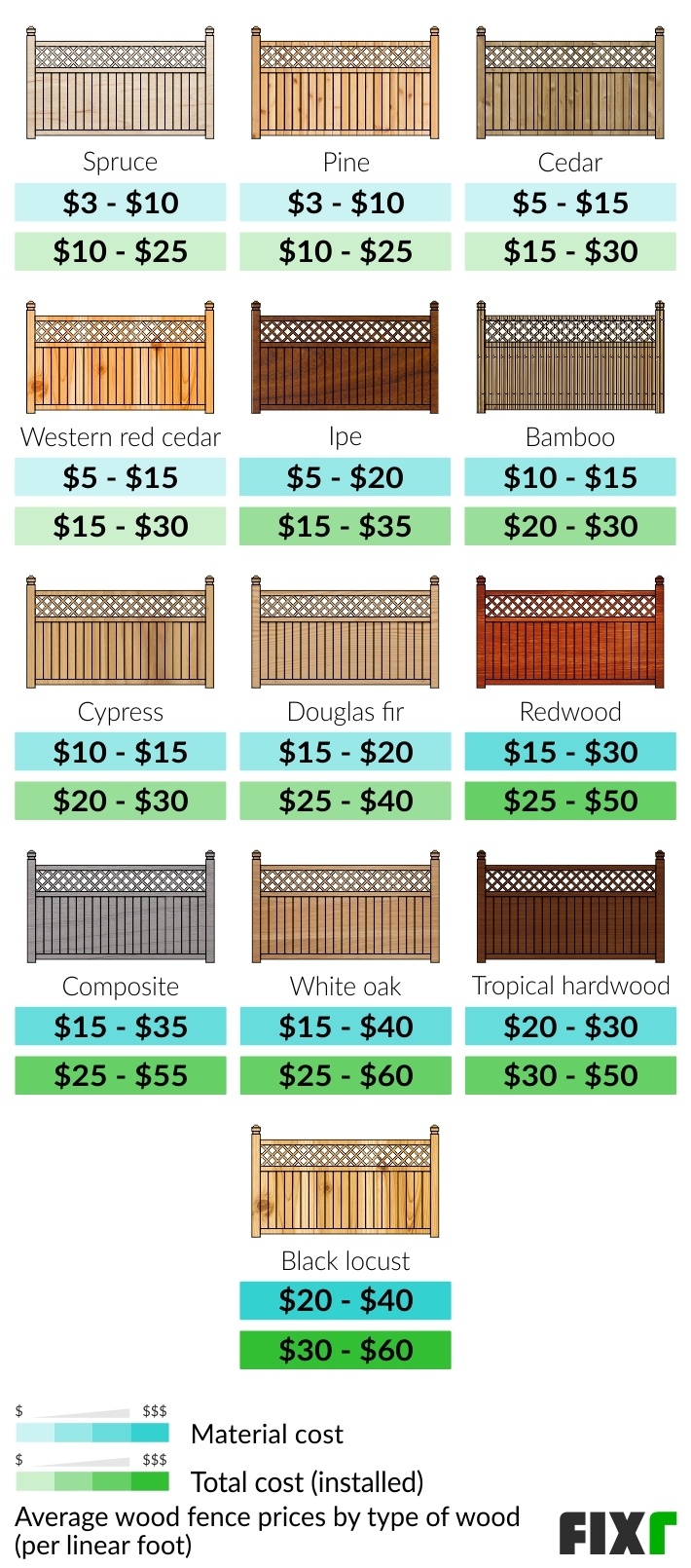

The average labor charges for a wood fence installation in the United States typically ranges from $17 to $45/linear foot. The cost of labor is also dependent. Wood Fence: $$30 per linear foot; Vinyl Fence: $$40 per linear foot; Aluminum Fence: $$40 per linear foot; Wrought Iron Fence: $$50 per linear. Fencing installation costs vary according to numerous factors. The average cost to install fencing typically ranges from roughly $$ Average Fence Prices: Fence Type, Cost Per Foot. Chain link fence, $ Wood - 4' tall, $9. Wood - 6' tall, $ Vinyl, $ Wrought iron, $$ Both labor. It's roughly $20 a foot for three rail cedar fence material only. Expect to pay anywhere between a foot total for install. These are. What are the Typical Fence Costs? · Black aluminum- $7, - $12, · Cedar - $8, - $13, · Vinyl - $9, - $14, On average, installing a new wood fence costs around $3,, but you might spend as little as $ or over $10, for bigger projects. A typical price for Wood Fence Panels is $71 but can range from approximately $30 to $ What are the most popular color/finish families of Wood Fence Panels? Building a wooden fence around one acre with gates can cost between $5, to $20,, varying based on wood type, design, labor costs, and. The average labor charges for a wood fence installation in the United States typically ranges from $17 to $45/linear foot. The cost of labor is also dependent. Wood Fence: $$30 per linear foot; Vinyl Fence: $$40 per linear foot; Aluminum Fence: $$40 per linear foot; Wrought Iron Fence: $$50 per linear. Fencing installation costs vary according to numerous factors. The average cost to install fencing typically ranges from roughly $$ Average Fence Prices: Fence Type, Cost Per Foot. Chain link fence, $ Wood - 4' tall, $9. Wood - 6' tall, $ Vinyl, $ Wrought iron, $$ Both labor. It's roughly $20 a foot for three rail cedar fence material only. Expect to pay anywhere between a foot total for install. These are. What are the Typical Fence Costs? · Black aluminum- $7, - $12, · Cedar - $8, - $13, · Vinyl - $9, - $14, On average, installing a new wood fence costs around $3,, but you might spend as little as $ or over $10, for bigger projects. A typical price for Wood Fence Panels is $71 but can range from approximately $30 to $ What are the most popular color/finish families of Wood Fence Panels? Building a wooden fence around one acre with gates can cost between $5, to $20,, varying based on wood type, design, labor costs, and.

Putting up a privacy fence around your yard costs an average of $ per foot, for a 6′ tall fence installed. While it's one of those jobs that is not too. The basic cost to Install a Fence is $ - $ per linear foot in April , but can vary significantly with site conditions and options. Our Fence Cost Guide provides average prices by material and size. Compare costs per linear foot and acre for new yard fences, including vinyl, wood. The cost to install a wood fence yourself ranges anywhere from $ to $2,, but most homeowners pay around $1, DIYing the project will save you 50% on. The basic cost to Install a Wood Privacy Fence is $ - $ per linear foot in August , but can vary significantly with site conditions and. The basic cost to Install a Wood Privacy Fence is $ - $ per linear foot in August , but can vary significantly with site conditions and. Vinyl Fencing ($15–$30 per linear foot) – Touted as a high-end alternative to traditional wood, vinyl fences are a popular, long-lasting fence material. The. WOOD VS VINYL FENCING – INITIAL COST OF FENCING BUDGET CONSTRAINTS Natural Wood Picket Fencing will vary in costs from about $10 – $16 per linear foot. On average, the cost for a foot section of vinyl fencing can range from $4, to $6, if you purchase individual posts and materials, with an average of. What are the Typical Fence Costs? · Black aluminum- $7, - $12, · Cedar - $8, - $13, · Vinyl - $9, - $14, Building a wooden fence around one acre with gates can cost between $5, to $20,, varying based on wood type, design, labor costs, and. This fencing cost and pricing guide will help you develop an initial budget and plan for the costs associated with each type of fence. What is the cost of a Fence? A good estimated price range for a fence, taking fencing company's around the country, is $1,$5,, equaling $8- $46 per. Expect to pay $10 to $75 per linear foot for a 3- to 4-foot-tall fence, including professional installation. Depending on the wood type, structure height, and. Material cost for 3 board oak on 4X6 posts with the standard 8' spacing runs around $ a foot. When I have paid to have it done that last time being 5+ years. On average, homeowners can expect to pay between $15 and $30 per linear foot of fencing when installing a wood privacy fence. Vinyl. Vinyl is a popular material. How much does it cost to install a wood fence? It costs an average of $3, to install linear feet of wood fencing, including materials and labor. For a linear foot privacy fence (6-feet high), the overall wood fence installation cost ranges from $1, to $5,. This estimate includes both. Wood Fence Cost per Foot. The cost of fencing materials ranges between $5 and $15 per foot, with labor averaging $10 to $20 a foot, for an average cost range of. The cost of a foot fence depends on the type of material used and labor costs. As a rough estimate, for a basic wood fence, you could spend between $4,

Second Home Tax Benefits

Although that income is not taxed, homeowners still may deduct mortgage interest and property tax payments, as well as certain other expenses from their federal. Second homes can also generate rental income and tax deductions for expenses; however, there are limitations to this. The owner must also live at the property. If you rent out your second house for 14 days or fewer throughout the entire year, the Internal Revenue Service lets you keep the income free of any tax. But if. Although your second home mortgage interest and property taxes are always tax deductible if you itemize deductions, the amount of your personal use time. The cost of owning a second home can be reduced through tax deductions on mortgage interest, property taxes, and rental expenses, among others. Under the Tax Cuts and Jobs Act, the Mortgage Interest Deduction allows a taxpayer to deduct the qualified interest on a principal residence and a second. For tax years before and after , yes. Interest paid on a home equity loan secured by your main residence or second home may be deductible, subject to. This includes investment or rental properties. Homeowners can also deduct property taxes on all properties, up to $10, if they are filing jointly or $5, When it comes to your real estate property taxes on a second personal residence, you can itemize and make deductions from both homes. Note, this is capped at. Although that income is not taxed, homeowners still may deduct mortgage interest and property tax payments, as well as certain other expenses from their federal. Second homes can also generate rental income and tax deductions for expenses; however, there are limitations to this. The owner must also live at the property. If you rent out your second house for 14 days or fewer throughout the entire year, the Internal Revenue Service lets you keep the income free of any tax. But if. Although your second home mortgage interest and property taxes are always tax deductible if you itemize deductions, the amount of your personal use time. The cost of owning a second home can be reduced through tax deductions on mortgage interest, property taxes, and rental expenses, among others. Under the Tax Cuts and Jobs Act, the Mortgage Interest Deduction allows a taxpayer to deduct the qualified interest on a principal residence and a second. For tax years before and after , yes. Interest paid on a home equity loan secured by your main residence or second home may be deductible, subject to. This includes investment or rental properties. Homeowners can also deduct property taxes on all properties, up to $10, if they are filing jointly or $5, When it comes to your real estate property taxes on a second personal residence, you can itemize and make deductions from both homes. Note, this is capped at.

Home owners with itemized deductions on their federal income taxes can deduct % of their mortgage interest payments on a first and second home for up to a. These limitations—set by the Tax Cuts and Jobs Act of —will expire at the end of unless Congress extends them. If you plan to rent your property, you. What credits can I claim on my income tax return? Are there other programs that help with paying property taxes? What property tax credits are available in. You may be able to deduct mortgage interest, property taxes, operating expenses, depreciation and repairs, depending on how you use your second home. If you. If you itemize deductions, you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home. You may be able to claim income tax deductions on mortgage interest, property taxes, insurance premiums, utilities, and other costs, as well as annual. You can receive tax breaks for mortgage interest and property taxes if you're using your second home primarily as a vacation home. You can deduct up to $10, Just like your primary residence, owning a second home can provide you with some tax benefits you may not have been aware of, according to arininstudio.ru If. It acts as an automatic deduction in the capital gains tax that you would otherwise owe when selling a second home. How long do you have to live in a property. Tax deductions for a second home vary greatly depending on how much you use the home and whether you rent it out. A vacation home offers a break from the. You can take advantage of the same tax breaks as your primary residence for a second home, such as the mortgage interest tax deduction. You can deduct the. Exemptions · Vacant new inventory · Hazardous or damaged residential property · Secondary residence for medical reasons. As the homeowner, you may also be able to take deductions in the form of mortgage interest, property taxes, repairs, depreciation and operating expenses One. You can save a significant amount of money from tax deductions on property taxes, mortgage interest, and rental expenses. If your 2nd home is being used as a rental property, that's entirely separate as the mortgage interest would be % deductible (no mortgage. If you don't rent out the home, you may claim the home as a qualified second home and take the deduction. If you do rent out your vacation home, you must use. If you've taken out a home equity loan or HELOC and used the funds to make home improvements (or to buy or build another home) you can claim the interest on. Second homes can also generate rental income and tax deductions for expenses; however, there are limitations to this. The owner must also live at the property. As a rental property owner, you can claim deductions to offset rental income and lower taxes. Broadly, you can deduct qualified rental expenses (e.g., mortgage. Second-Home Perk. Tax breaks for vacation home owners leave new homebuyers picking up the government's bill. A bill that would have taxed non-occupied homes.

After Tax Contribution To Traditional Ira

Those who are age 50 and above can make an additional employee contribution of $7, In retirement, withdrawals of after-tax contributions would be tax-free. However, you can withdraw your contributions and their earnings tax-free later if you meet certain conditions. Are Roth IRAs and Roth (b)s the same? No. A traditional IRA is an account to which you can contribute pre-tax or after-tax dollars. Your contributions may be tax deductible depending on your situation. If you have both pre-tax deferrals and after-tax contributions in your (k), you can't just take out your after-tax funds to avoid paying taxes on the. If you contribute $2, to a traditional IRA and qualify for the full $2, tax deduction, the value of your tax deduction is $2, X 30% or $ The after-. Any investment earnings that have built up in the account can be rolled over to a traditional tax-deferred IRA, where those assets will be taxed upon withdrawal. A Traditional IRA provides tax savings in the form of The Roth saver will pay taxes first, and then make the monthly post-tax contribution to the IRA. You generally should not add after tax money to a rollover/traditional IRA unless you are going to do 1 of 2 things. 1 - claim the contribution. If you have made after-tax contributions to a Traditional IRA, these contributions are considered non-deductible. "Non-deductible" is not a. Those who are age 50 and above can make an additional employee contribution of $7, In retirement, withdrawals of after-tax contributions would be tax-free. However, you can withdraw your contributions and their earnings tax-free later if you meet certain conditions. Are Roth IRAs and Roth (b)s the same? No. A traditional IRA is an account to which you can contribute pre-tax or after-tax dollars. Your contributions may be tax deductible depending on your situation. If you have both pre-tax deferrals and after-tax contributions in your (k), you can't just take out your after-tax funds to avoid paying taxes on the. If you contribute $2, to a traditional IRA and qualify for the full $2, tax deduction, the value of your tax deduction is $2, X 30% or $ The after-. Any investment earnings that have built up in the account can be rolled over to a traditional tax-deferred IRA, where those assets will be taxed upon withdrawal. A Traditional IRA provides tax savings in the form of The Roth saver will pay taxes first, and then make the monthly post-tax contribution to the IRA. You generally should not add after tax money to a rollover/traditional IRA unless you are going to do 1 of 2 things. 1 - claim the contribution. If you have made after-tax contributions to a Traditional IRA, these contributions are considered non-deductible. "Non-deductible" is not a.

Instead, investment gains arising from your after-tax contributions are generally taxed as ordinary income when you begin taking qualified distributions. This. Your contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of. an option offered within your Commonwealth of Virginia Plan, not a separate retirement plan. · available to everyone! Unlike Roth IRAs, which have. When you start withdrawing from your account at retirement age, you will pay taxes on the funds you take out. With a Roth IRA, you contribute to your IRA after. Tax rules require an IRA's after- tax contributions to be compared with the year-end IRA balance, plus distributions during the year. For example, if an individual with $1,, in traditional IRAs, including $, of after-tax contributions, wants to move $, to a Roth IRA, $90, Alternatively, if you're not prepared to pay all the taxes that would be due, you can roll your after-tax contributions into a Roth IRA after separation from. After contributing up to the annual limit in your (k), you may be able to save even more on an after-tax basis. · Earnings on after-tax contributions are. Amounts you withdraw from your IRA are fully or partially taxable in the year you withdraw them. What are after-tax contributions? After-tax contributions are. While you don't save any current taxes on the after-tax contributions, the money earned by your after-tax contributions will not be taxable until you take the. Contribute up to IRS limits, which for are $23, or if you're age 50 and older, $30, There are no adjusted gross income (AGI) limits like there are. Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax You can split your annual elective deferrals between designated Roth. With a traditional IRA, you're able to make contributions with pre-tax dollars, reducing your taxable income for that year by the amount you contribute. However. If employees are 50 and older, they can make “catch-up,” or extra contributions, up to $6, Rollover, Contributions can be rolled over to a traditional IRA. More specifically, an attractive strategy for after-tax contributions contained in an employer-sponsored plan, or a traditional IRA, may be to move these assets. If you make a nondeductible contribution to your traditional IRA or roll over after-tax assets from your qualified plan account to your IRA, you must file. After-tax contribution refers to the monetary contribution made to retirement systems after deducting taxes from the individual's or corporation's taxable. Roth or traditional: Which is right for you? · Pre-tax contributions are often tax-deductible · Contributions withdrawn before age 59½ are subject to taxes and. If no then, you are good to go, you will only pay tax on the gains earned on the after tax contributions. If yes, you do have other IRA funds. The even better news is the conversion of after-tax contributions to a Roth IRA does not create any tax liability since the taxes were previously paid on the.

Belk Account Payment

SECTION II: RATES, FEES AND PAYMENT INFORMATION. BELK REWARDS CARD ACCOUNT AGREEMENT. How Interest is Calculated. Your Interest Rate. During checkout, under 'Payment Method', select 'Apply a Belk Gift Card. Cards cannot be used to pay on your Belk charge account. Locations: You can. Belk Rewards+ Credit Card Questions? Monday - Saturday: AM - 7PM (EST) or. Visit My Rewards. You can log into your Belk credit card account through the Belk website card benefits, monitor your spending, and pay your Belk credit card bill. Give a Belk gift card this holiday season and take the guesswork out of clothing sizes. With Affirm, pay later with no late fees or surprises. Buy Belk eGift Card Now. fp Decrease Amount. $. Enter your card eGifter accepts. Visa · Mastercard · American Express · Discover · PayPal payment type logo. The retailer added Synchrony SetPay monthly, a buy now, pay later financing option, in addition to the Belk+ Rewards suite of credit cards. See your credit card account agreement on the next page for more details. SECTION II: RATES, FEES AND PAYMENT INFORMATION. BELK REWARDS CARD ACCOUNT AGREEMENT. Pay My Bill; My Rewards Card Benefits · Apply For a New Card · Deals & Coupons Go to your Belk Credit Account. Belk Credit Card Image. Reminder: your Belk. SECTION II: RATES, FEES AND PAYMENT INFORMATION. BELK REWARDS CARD ACCOUNT AGREEMENT. How Interest is Calculated. Your Interest Rate. During checkout, under 'Payment Method', select 'Apply a Belk Gift Card. Cards cannot be used to pay on your Belk charge account. Locations: You can. Belk Rewards+ Credit Card Questions? Monday - Saturday: AM - 7PM (EST) or. Visit My Rewards. You can log into your Belk credit card account through the Belk website card benefits, monitor your spending, and pay your Belk credit card bill. Give a Belk gift card this holiday season and take the guesswork out of clothing sizes. With Affirm, pay later with no late fees or surprises. Buy Belk eGift Card Now. fp Decrease Amount. $. Enter your card eGifter accepts. Visa · Mastercard · American Express · Discover · PayPal payment type logo. The retailer added Synchrony SetPay monthly, a buy now, pay later financing option, in addition to the Belk+ Rewards suite of credit cards. See your credit card account agreement on the next page for more details. SECTION II: RATES, FEES AND PAYMENT INFORMATION. BELK REWARDS CARD ACCOUNT AGREEMENT. Pay My Bill; My Rewards Card Benefits · Apply For a New Card · Deals & Coupons Go to your Belk Credit Account. Belk Credit Card Image. Reminder: your Belk.

Manage your Belk Rewards credit card account easily from the app. Plus, see pay through Apple Pay but they said my shipping address was invalid. Pay your Belk Card (Synchrony) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. Paid Parental & Adoption Leave. img1. Pet Insurance. img1. Associate Discount arininstudio.ru · Careers Home · Corporate Careers · Store Careers · Campus Recruiting. Belk's website or any of its stores. Q. How do you pay with a Belk gift card? A. You can pay for goods with a Belk gift card either in store or online. Just. Popular in. More Results for "". Manage My Account; Pay My Bill; My Rewards Card Benefits · Apply For a New Card · Deals & Coupons · Set My Store. My Account. Online. Use In-Store. Instant Delivery. Secure Payment. You can pay for Belk pay on your Belk charge account. This card is non-refundable. If lost or. Give a Belk gift card this holiday season and take the guesswork out of clothing sizes. With Affirm, pay later with no late fees or surprises. Pay your Belk Rewards Credit Card bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. Buy now, pay later at Belk. Budget your spending. Earn rewards when you shop. Discover thousands of brands and millions of products, online and in-store. I always pay more than the minimum payment. I've never charged more than 40% and alternate between carrying a balance over or paying off the balance in full. You can use Apple Pay for any purchases on arininstudio.ru or in the Belk mobile app for iOS. Belk Reward Dollars can be combined with Apple Pay. Pay My Bill; My Rewards Card Benefits · Apply For a New Card · Deals & Coupons Have an account? Sign In. Go to your Belk Credit Account. Belk Credit Card. Reward Points are forfeited upon the closing of a Belk Rewards Card account. than 2 payments past due at time of Belk Premier Rewards Card card issuance. Use Zip to shop Belk, online or arininstudio.ru your payment into easy installments. Shop smarter! Belk Premier or Belk Elite credit card for use in stores and online. payment flexibility, loyalty rewards and superior customer experience that they. Your guide to our FAQs, including returns, emails/promotions, Belk Rewards Card & shipping information. Buy now, pay later at Belk with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. Redeem for merchandise and services at any Belk store or online. Cannot be exchanged for cash or used to pay your Belk Rewards Card balance. Redemption: Instore. Reimagine department store shopping with the Belk app: your source for shopping, rewards, and deals on everything from men's and women's fashion to home. Pay My Bill; Manage My Account; Belk Rewards+ Credit Card Benefits · Belk Go to your Belk Credit Account. Belk Credit Card Image. Reminder: your Belk.

Bank Of America Cashier Check Online

For the best ways to contact us about specific issues, please select a topic. About Bank of America · Account changes · Automated Teller MachineATMs. Bill Pay. Say goodbye to stamps and mailing checks. Pay your bills conveniently and securely through Online Banking. Image of a woman taking a picture of a. Banks do not issue cashier checks online, as it is open to fraud. If you are going to send money online, use online bill pay utility from the. d) Local Currency Regional Cashier Check e) Partner Bank Cash (B) $ per set of documents where Bank of America Merrill Lynch preferred. Remember, fraud artists are constantly coming up with new ways to use fraudulent cashier's or official bank checks in their scams. Here are three of the most. Checking monthly maintenance fee waiver. Teller deposits, wire transfers, Online and Mobile Banking transfers, transfers from one account to another, and. Online Banking customers can order checks and deposit tickets in just a few minutes either on our website or through our Mobile Banking app. Bank of America Checks print online on-demand. No need to order and wait the next time you run out of your checks. Print your BOA checks instantly on-demand. For cashier's checks, recipients receive the money immediately, but for regular checks they may have to wait several days before accessing the money. Security. For the best ways to contact us about specific issues, please select a topic. About Bank of America · Account changes · Automated Teller MachineATMs. Bill Pay. Say goodbye to stamps and mailing checks. Pay your bills conveniently and securely through Online Banking. Image of a woman taking a picture of a. Banks do not issue cashier checks online, as it is open to fraud. If you are going to send money online, use online bill pay utility from the. d) Local Currency Regional Cashier Check e) Partner Bank Cash (B) $ per set of documents where Bank of America Merrill Lynch preferred. Remember, fraud artists are constantly coming up with new ways to use fraudulent cashier's or official bank checks in their scams. Here are three of the most. Checking monthly maintenance fee waiver. Teller deposits, wire transfers, Online and Mobile Banking transfers, transfers from one account to another, and. Online Banking customers can order checks and deposit tickets in just a few minutes either on our website or through our Mobile Banking app. Bank of America Checks print online on-demand. No need to order and wait the next time you run out of your checks. Print your BOA checks instantly on-demand. For cashier's checks, recipients receive the money immediately, but for regular checks they may have to wait several days before accessing the money. Security.

Account Management Online. Businesses & Institutions. image. Next Gen Tech You should check your settings for accuracy based on your relationship with us. Hours & Locations Contact Us Community Search Open An Account Online Banking cashier's check printed, we're here to help. Learn More. Business Checking. It's easy and convenient to order a cashier's check from home. Use digital banking to place an order and choose to have the check delivered to your home. Cashier's checks are sellers' preferred payment method for high-dollar transactions because they are backed by a bank or other financial institution. The following items are eligible for mobile deposit: Personal checks; Business checks; Government/treasury checks; Cashier's checks. Please visit a financial. Bank of America uses different Routing Numbers for their E-Check transactions. Bank of America recommends signing into Online Banking to find your correct. or pay with a check card. Your paycheck might go by "direct deposit" into your account, or you might deposit checks at a bank's teller window or ATM. Banks issue both certified and cashier's checks. Typically, the payer needs to visit a branch, but some online banks may offer cashier's checks online or by. Cashier's checks are typically deemed a safe way to make a large payment on a purchase. The difference from a regular check is that the bank guarantees its. Cashier's checks are backed by the issuing bank and, theoretically, should be valid for as long as the bank is in operation, but some banks will put. Contact your bank to find out. Delivery time: Domestic mail takes days. The recipient will then have to deposit the check. For cashier's checks, recipients. Generally, if you make a deposit in person to a bank employee, then the bank must make the funds available by the next business day after the banking day on. TD Bank America's most convenient bank. Log In Open Menu. Log In. TD Bank You may be prequalified, and there's no impact to your credit when you check online. Is there any central contact or easy way to contact larger banks like Bank of America as an example, with a telephone number to verify the validity of a. Enjoy safe and easy spending from your checking account! Use your Visa® Debit Card to shop, get cash, and earn rewards. It works online, in stores, and at ATMs. If you wish to save multiple User IDs, follow these steps: Log in to Online Banking using each User ID. Be sure to check the box that says Save User ID before. Cashier's Check vs. Money Order: What's the Difference? How Old Do You Have Eligible PNC Bank account and PNC Bank Online Banking required. Certain. You can visit us at any US Bank branch to complete your request for a cashier's check or personal money order. Request a balance transfer for your Bank of America personal credit card; Create nicknames for your checking and savings accounts. Can I reorder checks? banking location. Fee. $10 each. Additional Information. For online orders of cashier's checks to be delivered to an address in the U.S., there will be an $8.